📱 Top Personal Finance Apps for Malaysians (2025)

These apps help Malaysians budget, invest, and manage their money wisely. All are available on Google Play & App Store unless noted.

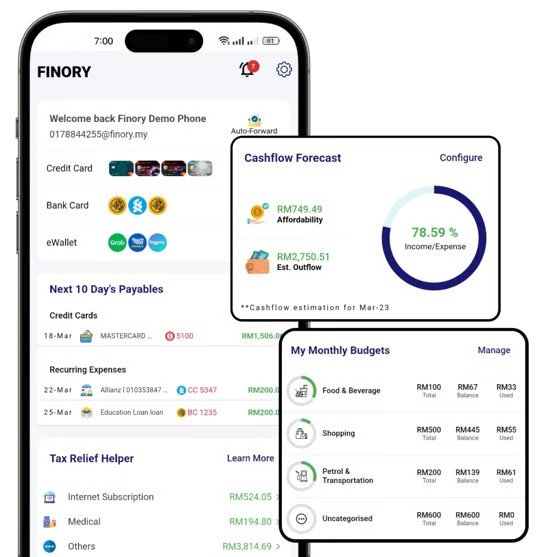

Finory

Local:

4.6 / 5

Moomoo

Local:

4.7 / 5

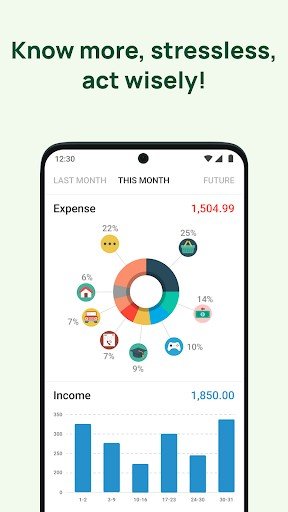

MoneyLah!

Local:

4.2 / 5

Money Lover

Local: 🌍 Global

4.7 / 5

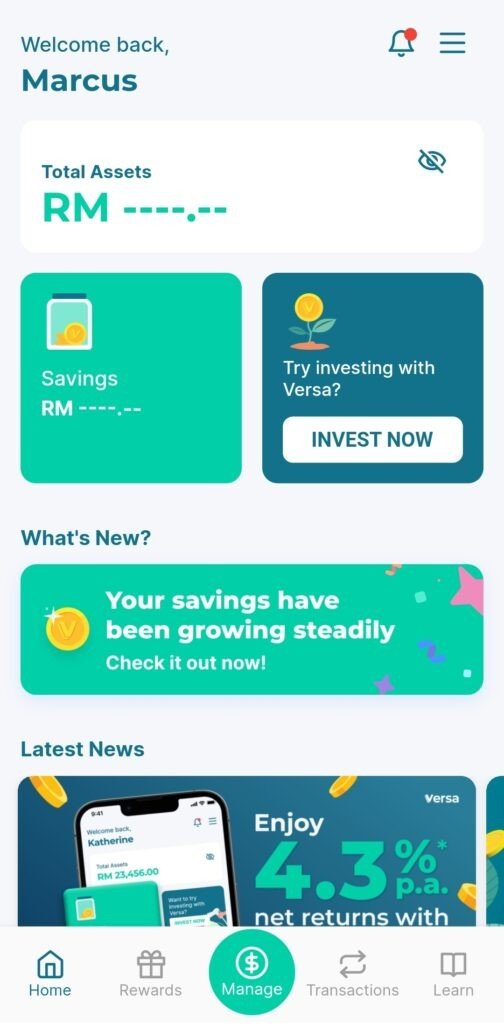

Versa Invest

Local:

4.4 / 5

Raiz

Local: 🌍 Global

4.6 / 5

StashAway

Local: 🌍 Global

4.6 / 5

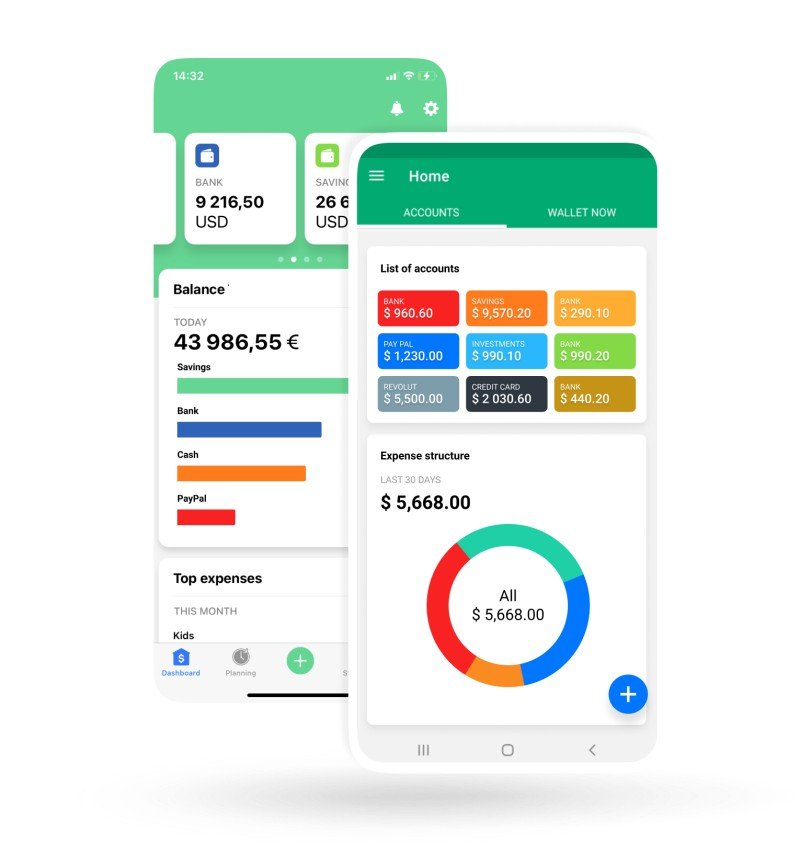

Wallet (BudgetBakers)

Local: 🌍 Global

4.4 / 5

Spendee

Local: 🌍 Global

4.5 / 5

Touch 'n Go GO+

Local:

4.4 / 5

BigPay

Local: 🌍 Global

4.2 / 5

Syfe

Local: 🌍 Global /

4.5 / 5

i-Akaun KWSP

Local:

2.5 / 5

MyCoverage

Local:

4 / 5

MySalam

Local:

4.1 / 5

Money Manager (Realbytes)

Local: 🌍 Global

4.7 / 5

Monefy

Local: 🌍 Global

4.6 / 5

Fast Budget

Local: 🌍 Global

4.6 / 5

Fortune City

Local: 🌍 Global

4.5 / 5

Monny

Local: 🌍 Global

4.6 / 5

Wally

Local: 🌍 Global

4 / 5

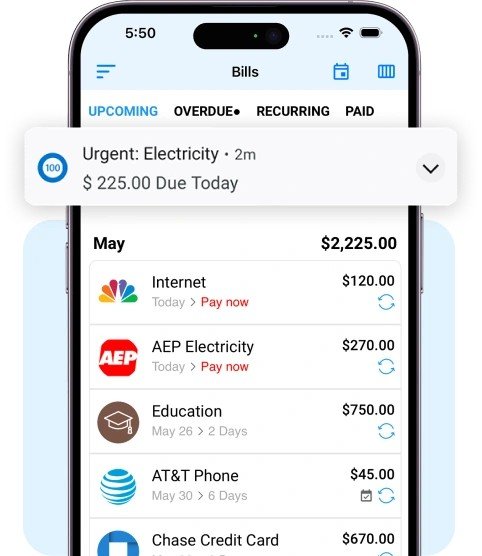

Timely Bills

Local: 🌍 Global

4.5 / 5

Buxfer

Local: 🌍 Global

4.3 / 5

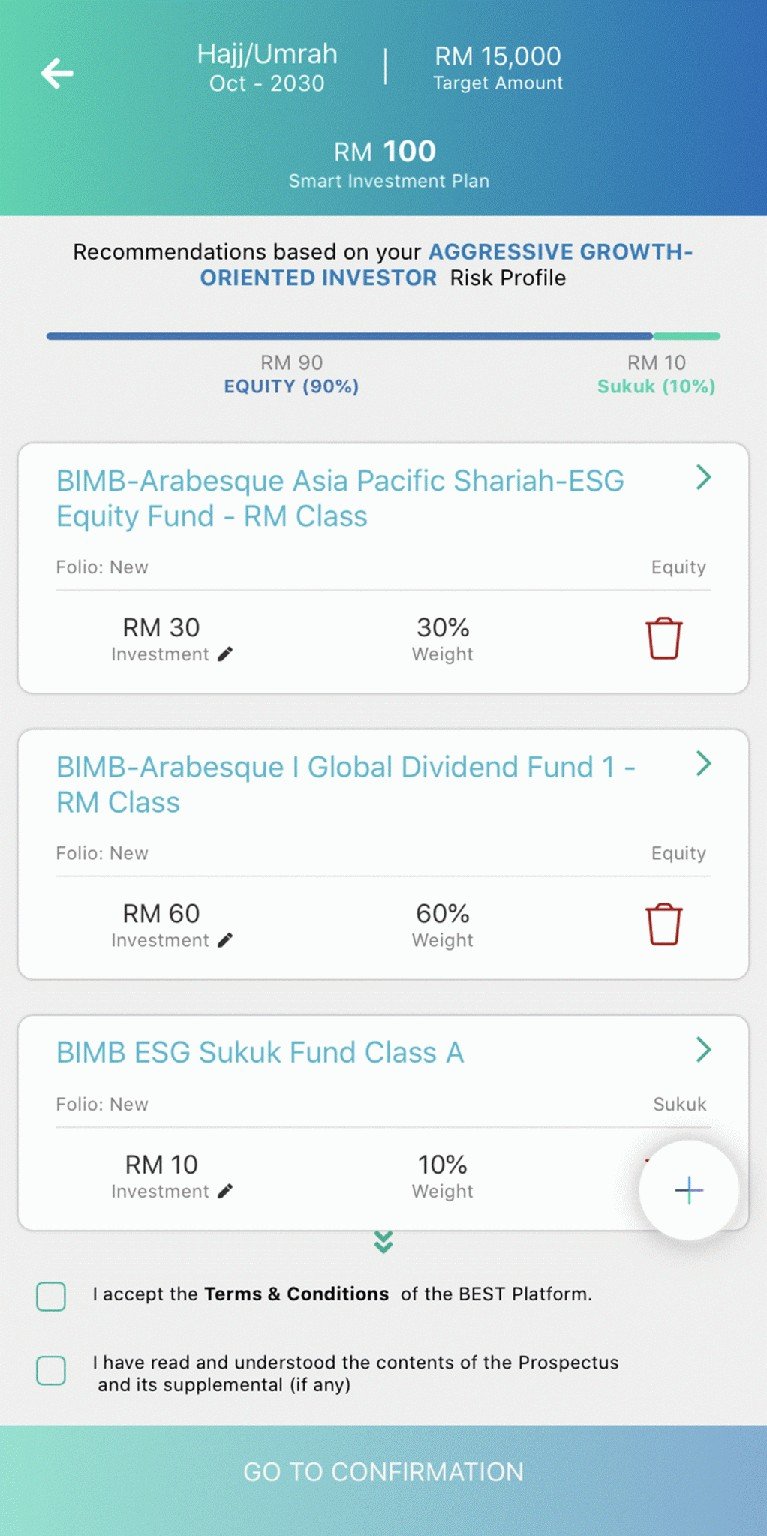

BEST Invest (BIMB)

Local:

4.3 / 5

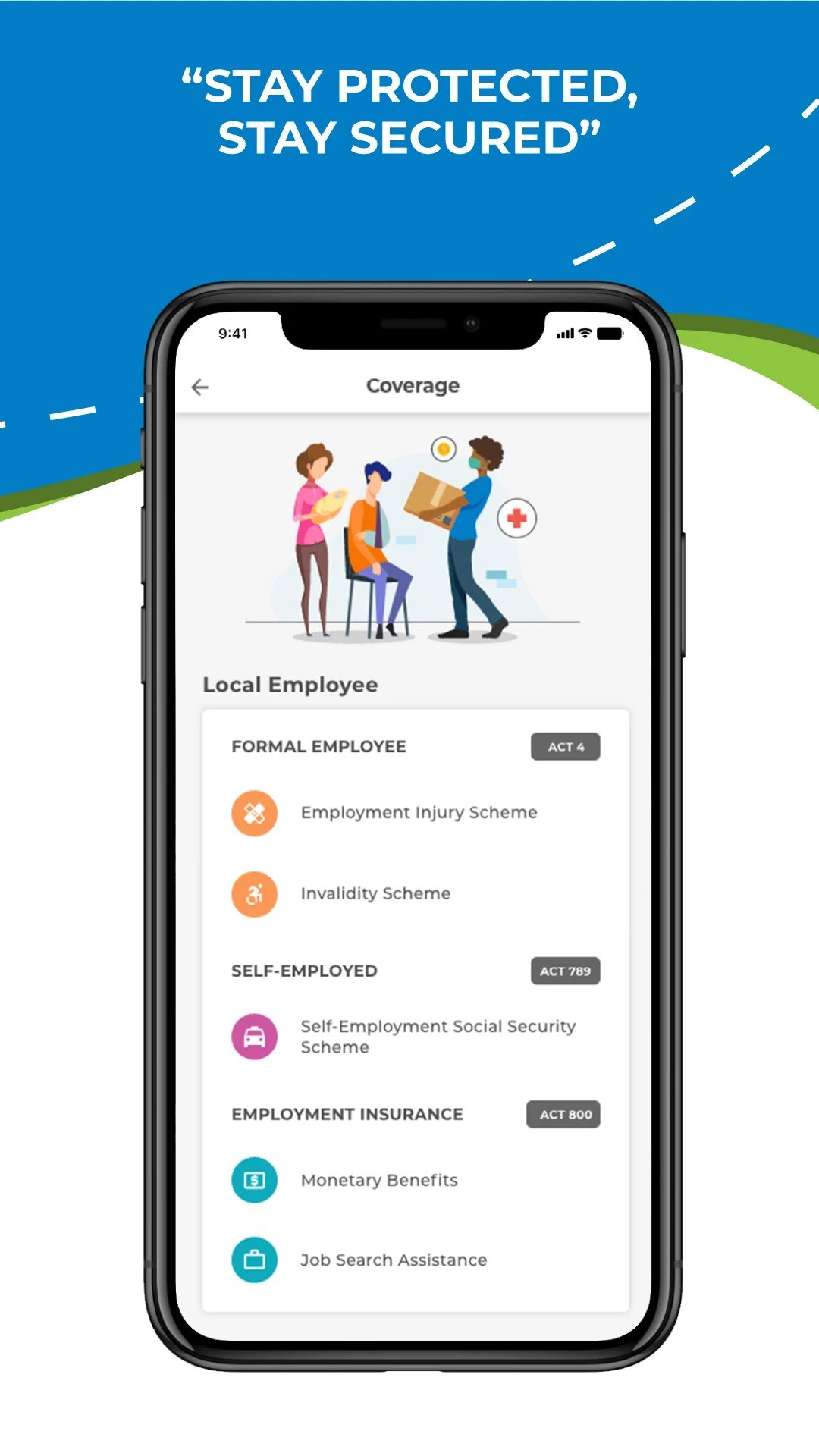

Prihatin (SOCSO)

Local:

2.4 / 5

Personal Finance in Malaysia (2025 Guide)

Personal Finance in Malaysia (2025 Guide)

Welcome to our 2025 Malaysian Personal Finance guide—covering budgeting apps, savings tools, retirement planning, and investment platforms to help you manage money smarter in an era of subsidy cuts, inflation, and growing financial needs.

📱 Top Personal Finance Apps for Malaysians (2025)

These apps help Malaysians budget, invest, and manage their money wisely. All are available on Google Play & App Store unless noted.

📊 App Comparison Table

App | Local Support | Bank Sync | Main Features | Pricing | User Rating (⭐) |

|---|---|---|---|---|---|

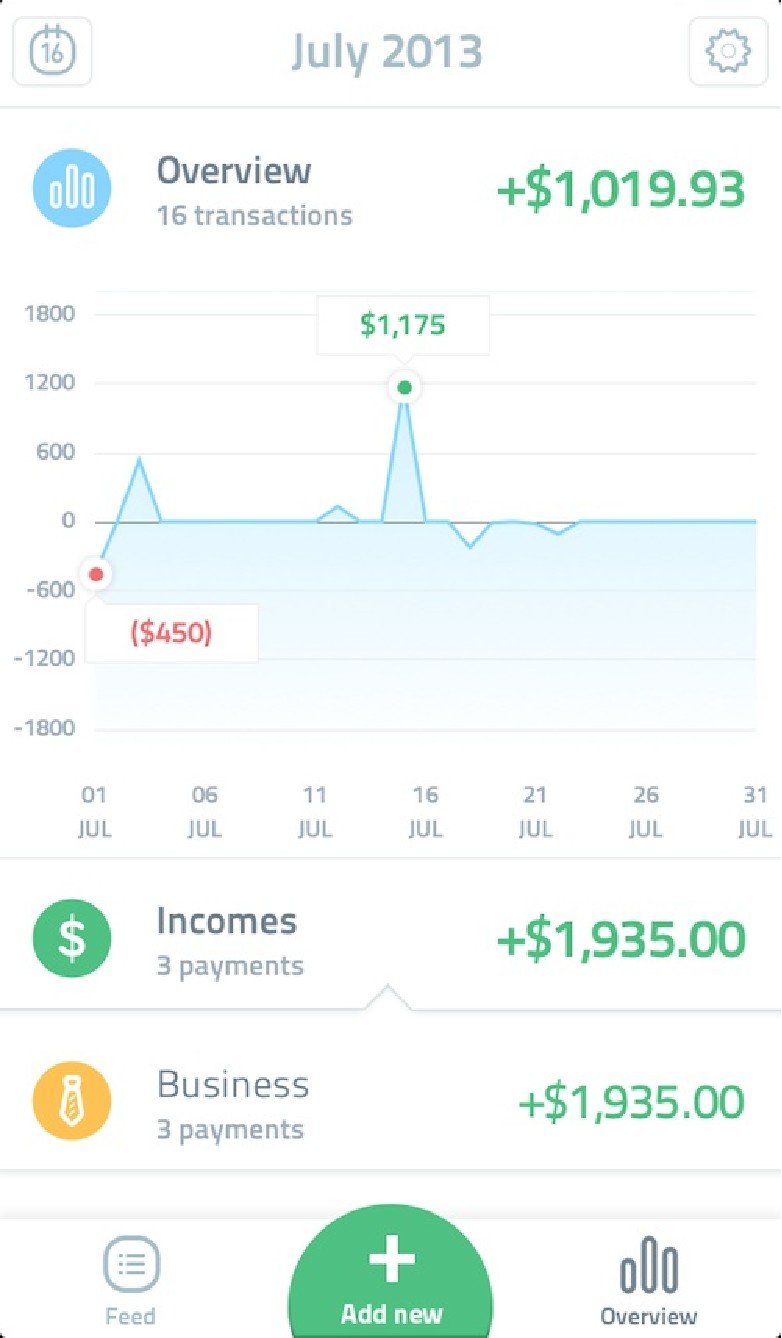

Finory | Yes | Yes | Full budgeting, e-wallets, bill reminders | Free / RM5.90/mo | 4.6 |

MoneyLah! | Yes | No | Visual budgets, simple tracker | Free | 4.2 |

Money Lover | Global | Yes | Debt tracking, multi-currency | Free / RM39.90 one-time | 4.5 |

Raiz | Yes | No | Robo investing, shariah-compliant | Low mgmt. fee | 4.6 |

Moomoo | Yes | No | Stocks, ETFs, real-time data | Free to start | 4.7 |

Wallet (BudgetBakers) | Global | Yes | Forecasting, multi-bank sync | Free / RM21.90/mo | 4.4 |

Spendee | Global | Yes | Visual budgets, shared wallets | Free / RM6.90/mo | 4.5 |

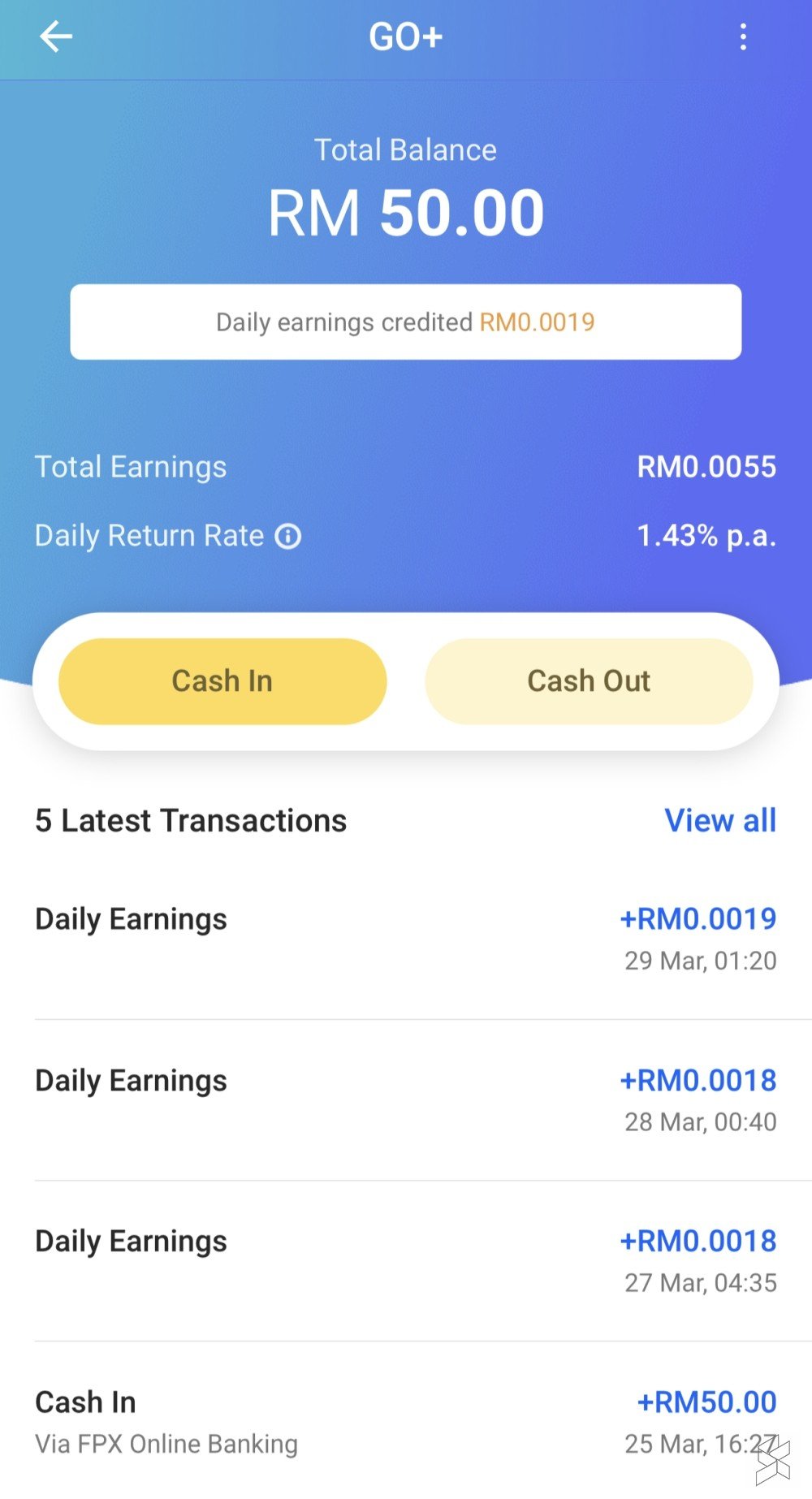

Touch 'n Go GO+ | Yes | Yes | Earn daily returns, linkable to TnG wallet | Free | 4.4 |

BigPay | Yes | Yes | Prepaid card, expense tracking, budgeting | Free | 4.2 |

Syfe | Global / SG | No | Wealth management, ETFs, robo-investments | Mgmt. fee from 0.35% | 4.5 |

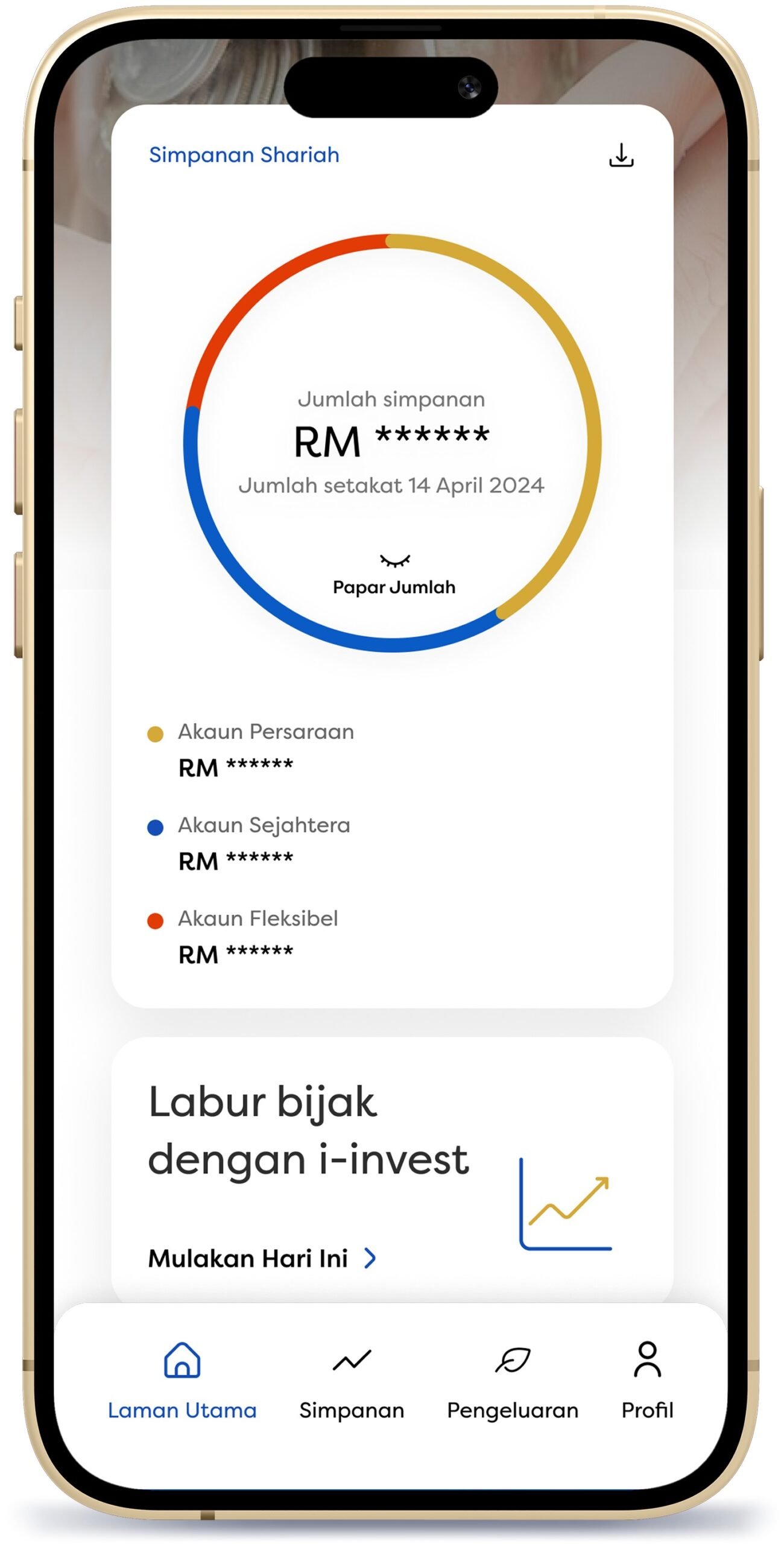

i-Akaun KWSP | Yes | No | Track EPF savings, apply withdrawals, i-Invest access | Free | 2.5 |

MyCoverage | Yes | No | Check insurance coverage, claim tracking | Free | 4 |

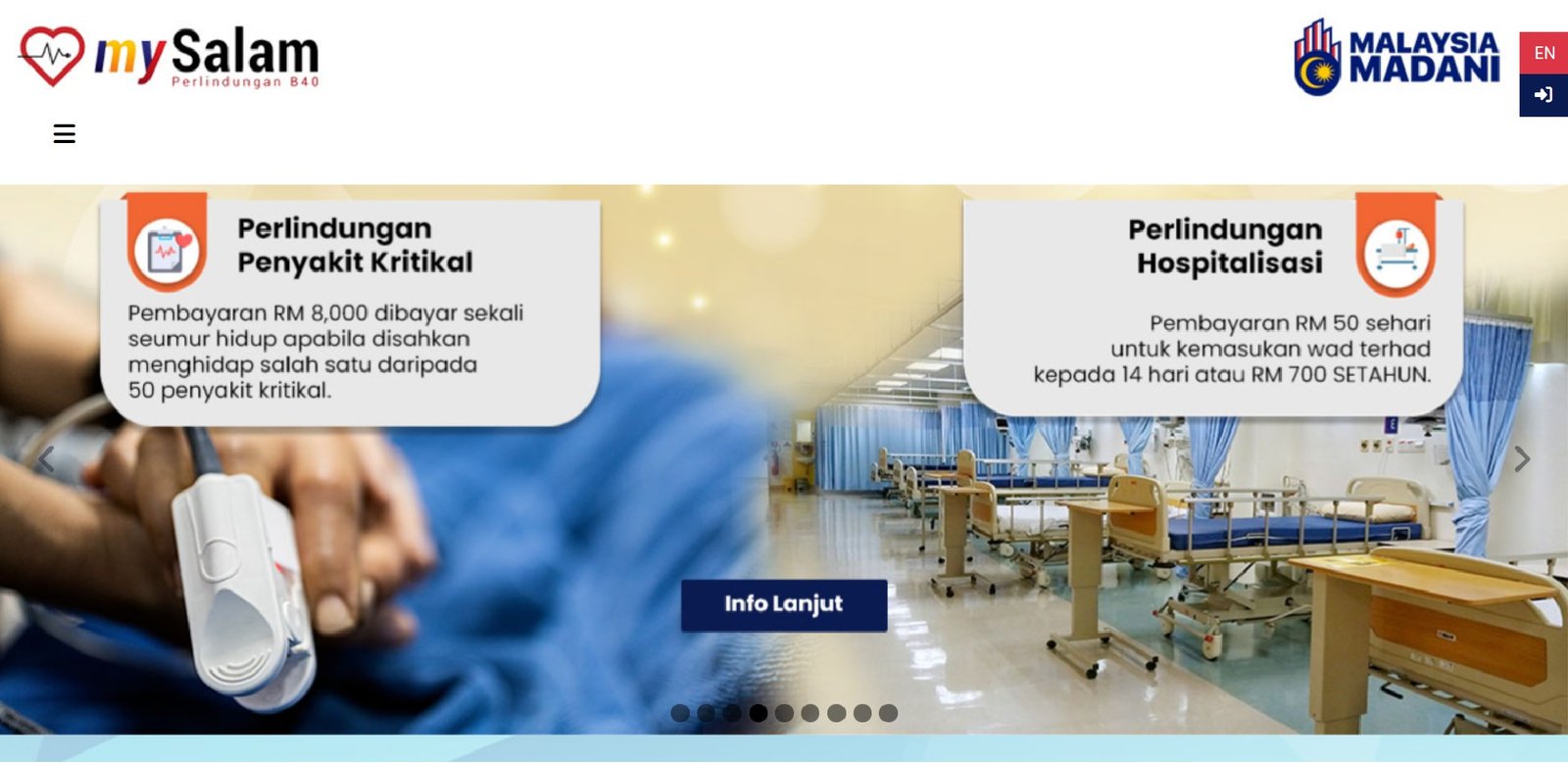

MySalam | Yes | No | Government health protection scheme | Free | 4.1 |

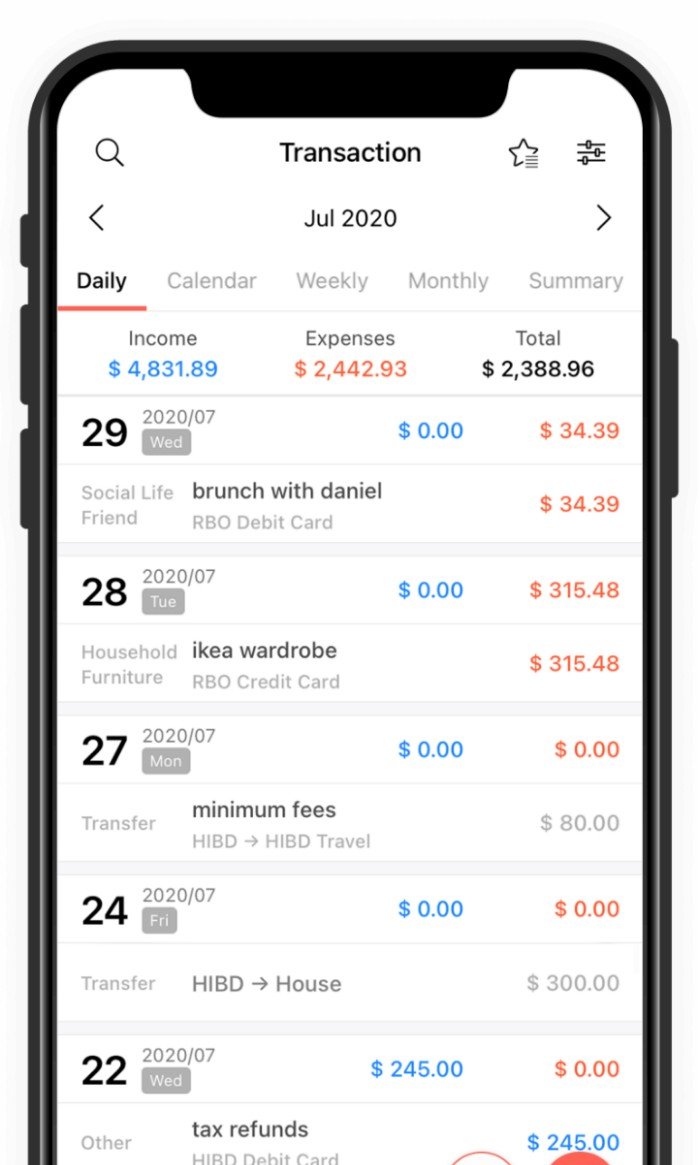

Money Manager (Realbytes) | Global | Yes | Simple UI, budget calendar, password lock | Free / Premium | 4.7 |

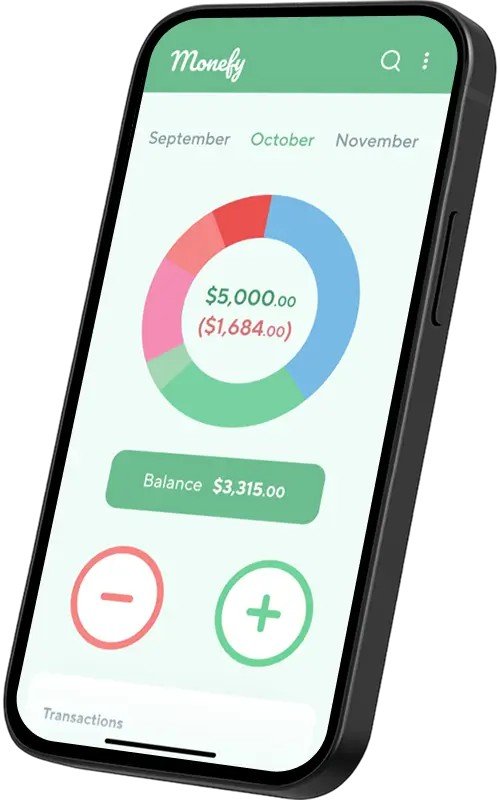

Monefy | Global | Yes | One-tap logging, charts, widgets | Free / Pro | 4.6 |

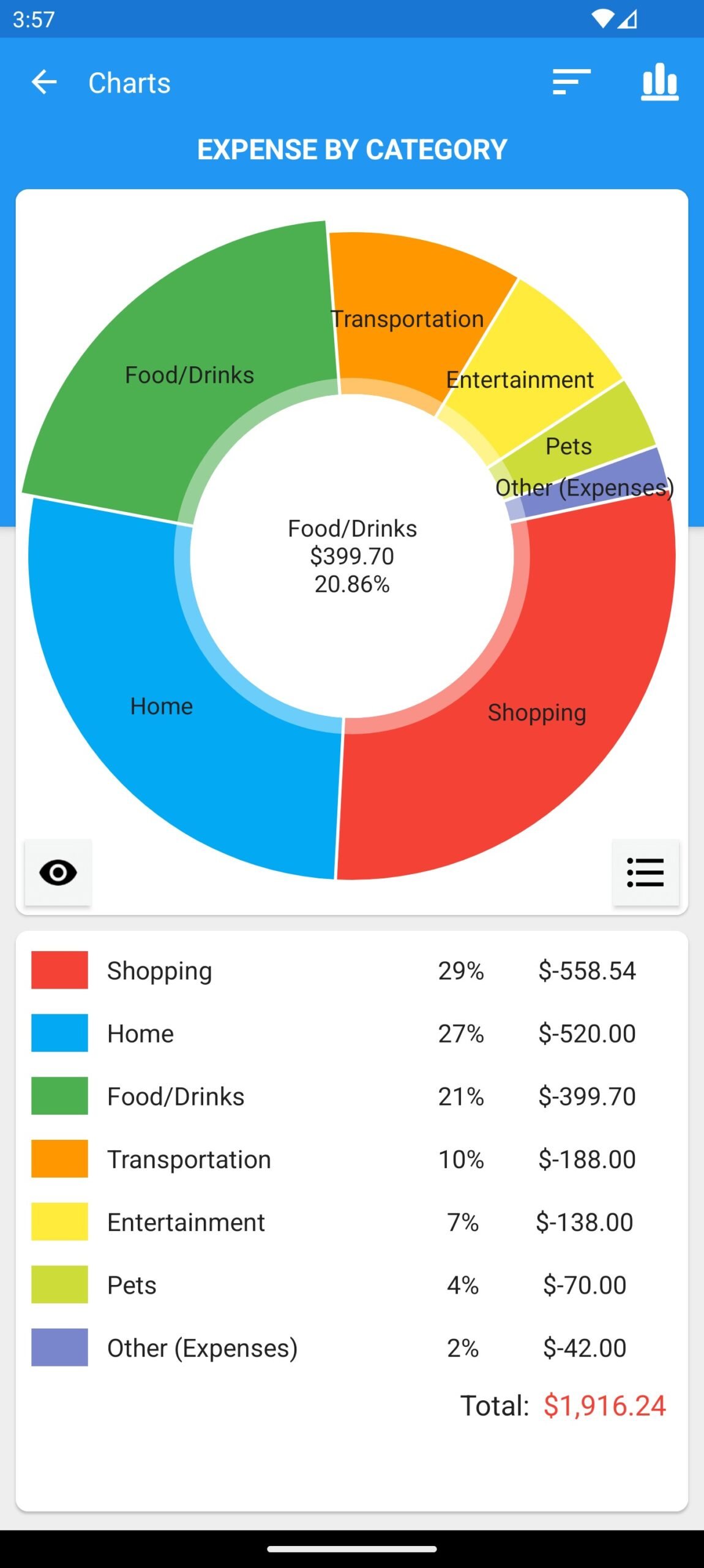

Fast Budget | Global | Yes | Categories, scheduled transactions, reports | Free / RM17.90 | 4.6 |

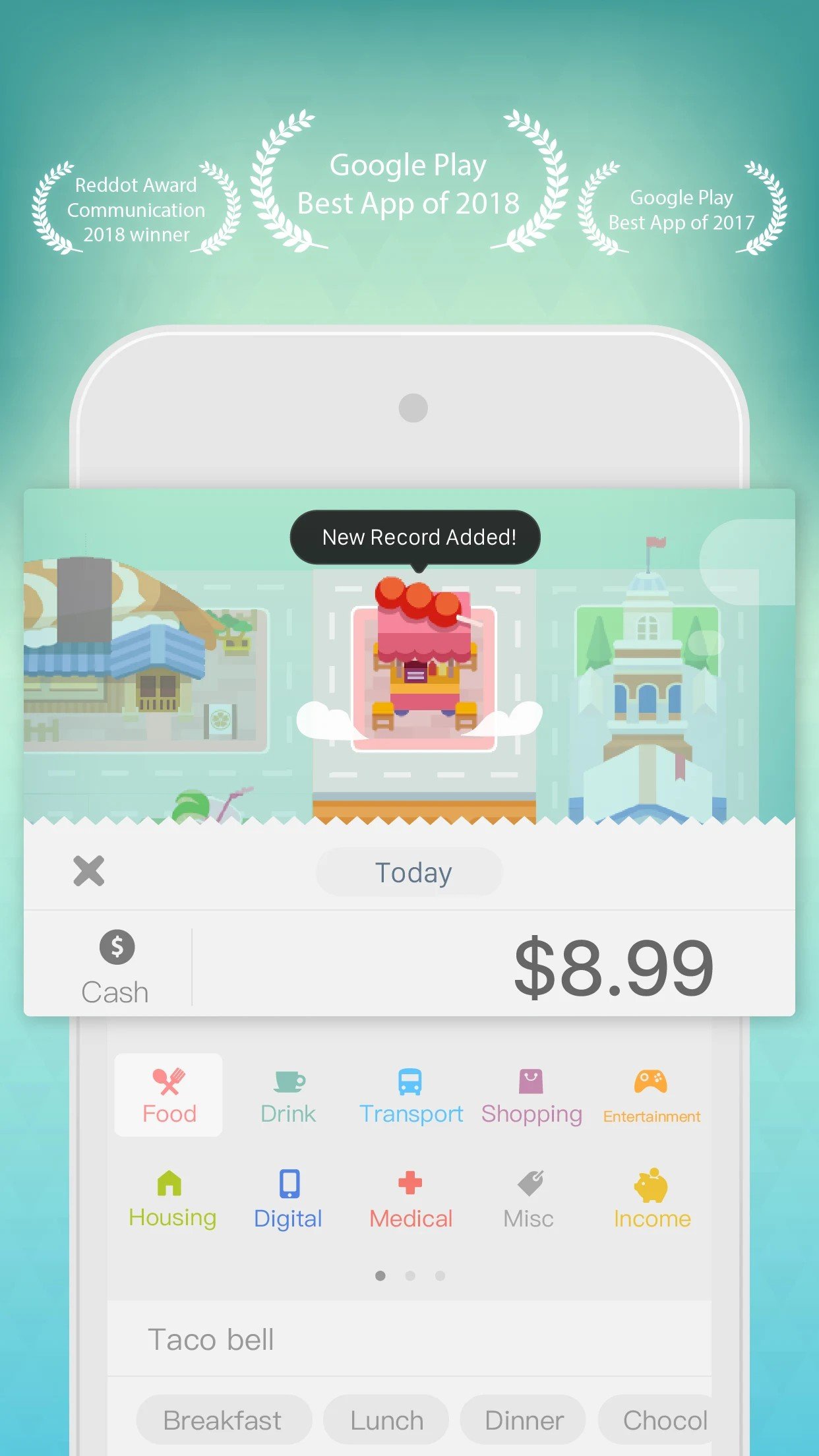

Fortune City | Global | No | Gamified expense tracking | Free / In-app | 4.5 |

Monny | Global | No | Playful design, goal saving | Free | 4.4 |

Wally | Global | Yes | Manual + linked tracking, group budgets | Free / Premium | 4 |

Timely Bills | Global | Yes | Bill planner, reminders, export | Free / Premium | 4.5 |

Buxfer | Global | Yes | Budget, forecast, debt split | Free / Plans available | 4.3 |

Versa Invest | Yes | No | Money market, PRS, fixed income funds | Free / mgmt fee | 4.4 |

BEST Invest (BIMB) | Yes | No | Shariah-compliant fund investments | Free / mgmt fee | 4.3 |

Prihatin (SOCSO) | Yes | No | Check SOCSO/EIS status, health screening, claims | Free | 2.4 |

📈 Top 5 Personal Finance Trends in Malaysia (2025)

- AI-powered budgeting & alerts — Apps like Finory and HeyAlfred use smart automation to help users track spending.

- High-yield savings & e-wallet returns — Platforms like TnG GO+ and Versa offer daily returns of up to 3–4%.

- Micro-investing & robo-advisors — Raiz, StashAway, and Versa Invest allow Malaysians to start investing with as little as RM5.

- Buy Now Pay Later (BNPL) for essentials — A survey shows 81% of Malaysians use BNPL responsibly, especially for household needs.

- Credit & debt management awareness — With high household debt, tools like MULA and MyTabung are becoming more important.

📋 2025 Malaysian Finance Toolkit

Goal | Recommended Tools | Key Benefits |

|---|---|---|

Budgeting & Tracking | Finory, HeyAlfred, MoneyLah! | Local bank sync, intuitive dashboards |

High-Yield Savings | TnG GO+, Versa, AEON Wallet | Earn up to 4% returns, flexible withdrawals |

Micro-Investing | Raiz, StashAway, Versa Invest | Shariah-compliant, robo-advised ETFs |

Credit & Debt Tools | MULA, Money Lover, MyTabung | Track cards, avoid overspending |

Insurance & Benefits | i-Akaun KWSP, MySalam, SOCSO apps | Government schemes, EPF insights |

🤖 Robo-Advisors Comparison (Malaysia 2025)

Platform | Minimum Investment | Shariah-Compliant | Fees | Key Features |

|---|---|---|---|---|

RM5 | ✅ | RM1.50/month (below RM6,000), 0.30% p.a. | Auto-invest spare change, educational videos | |

RM0 | ✅ (optional portfolios) | 0.2%–0.8% p.a. | Flexible goals, dynamic risk management | |

RM1 | ✅ | ~0.3%–1.0% fund-based | Unit trust platform with daily returns | |

RM10 | ✅ | Fund expense ratio | BIMB’s Shariah-compliant unit trust investing | |

RM100 | ❌ | 0.35%–0.65% | ETF-based portfolios, wealth planning |

✅ How to Start Improving Your Personal Finance in 2025

- Set monthly goals (e.g. save RM200).

- Use a bank-linked app like Finory or Money Lover.

- Automate savings into GO+ or Versa.

- Start investing in ETFs via Raiz or StashAway.

- Limit BNPL use, review your debt-to-income ratio monthly.

🧠 Frequently Asked Questions (FAQs)

1. What are the best high-yield savings options in Malaysia?

Look into Touch 'n Go GO+, Versa, and AEON Wallet for daily-dividend savings accounts that provide returns of up to 4%.

2. Is BNPL (Buy Now Pay Later) safe to use?

81% of Malaysians use BNPL responsibly. Stick to essentials and avoid overspending beyond your monthly capacity.

3. Are Malaysian finance apps Shariah-compliant?

Yes, platforms like StashAway, Versa, and BEST Invest offer Shariah-compliant investment options.

4. How can the 2025 budget changes impact my finances?

Subsidy cuts and new taxes may affect cost of living. Revisit your monthly budgets and automate savings accordingly.

5. Which app is best for first-time savers?

Try Finory or MyTabung. Both are beginner-friendly and offer local support.

Find the latest Gold and Silver Price Updates for Malaysia. Platform to explore Buy Gold Product, Gold Investment, Personal Finance, and Tools and Excel template.