Explore the top gold investment platforms available in Malaysia – from physical bullion dealers and Islamic banks to digital gold ETFs and robo-advisors.

Compare minimum investments, Shariah compliance, fees, and more to find the best fit for your gold savings strategy.

Click on each platform for a full review or to start investing.

Bursa Gold Dinar

Physical/Digital

4.4 / 5

Mercury Bullion Savings

Private

4.3 / 5

KGOLD (Kodimas)

Dealer

4.2 / 5

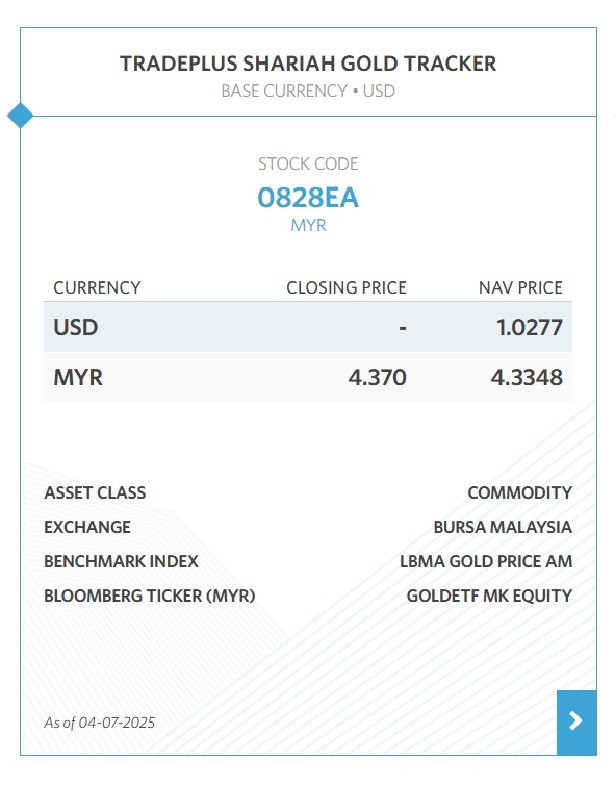

TradePlus Shariah ETF

ETF

4.5 / 5

KAP Gold

Dealer

4.1 / 5

HLeBroking Gold

Brokerage

4 / 5

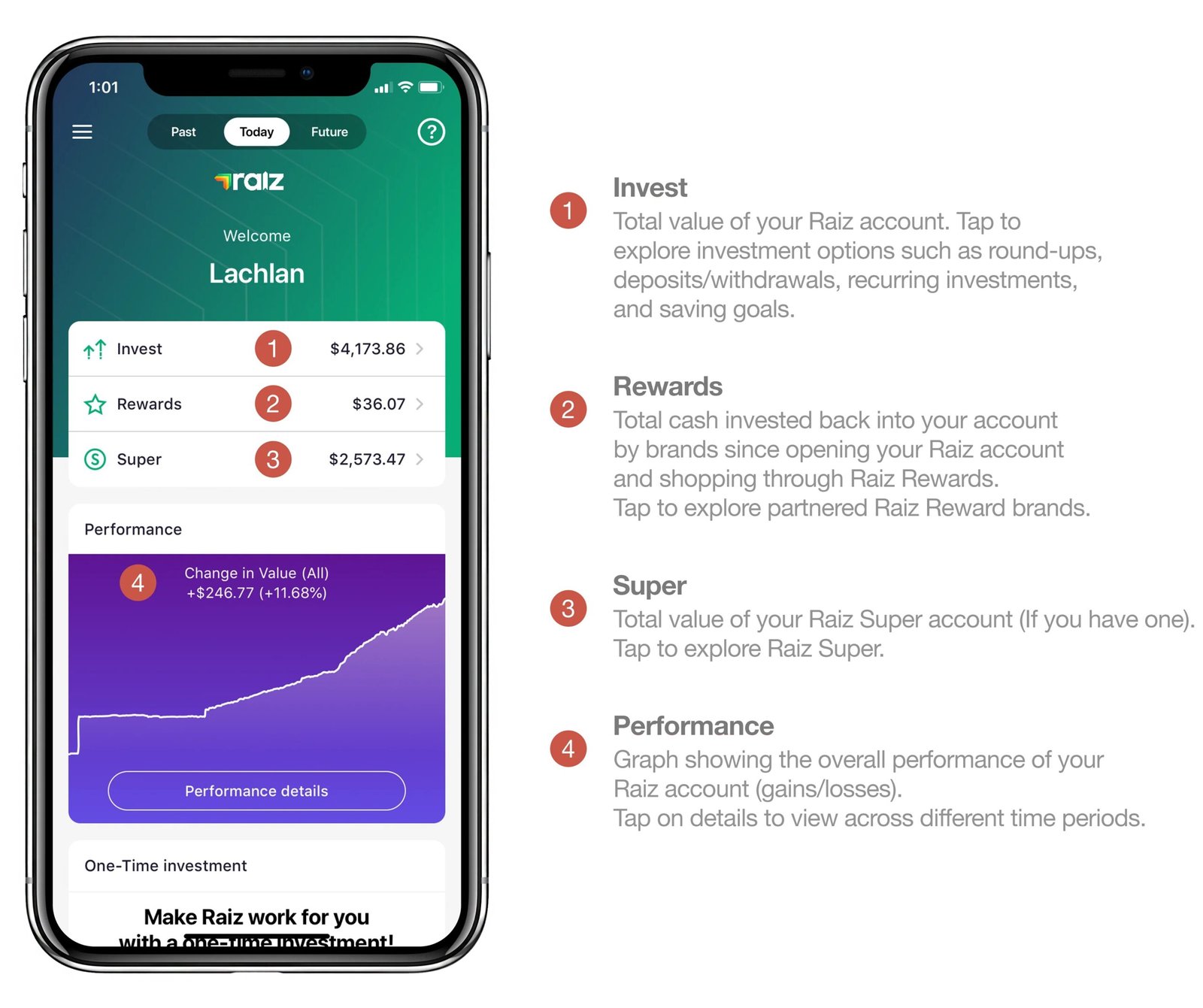

Raiz

Robo-Advisor

4.6 / 5

Versa Gold

Robo-Advisor

4.6 / 5

Quantum Metal

Private

3.8 / 5

Pitih Emas

Cooperative

4.2 / 5

Kijang Emas

Physical Coin

4.7 / 5

Al‑Rajhi Gold‑i

Bank

4.4 / 5

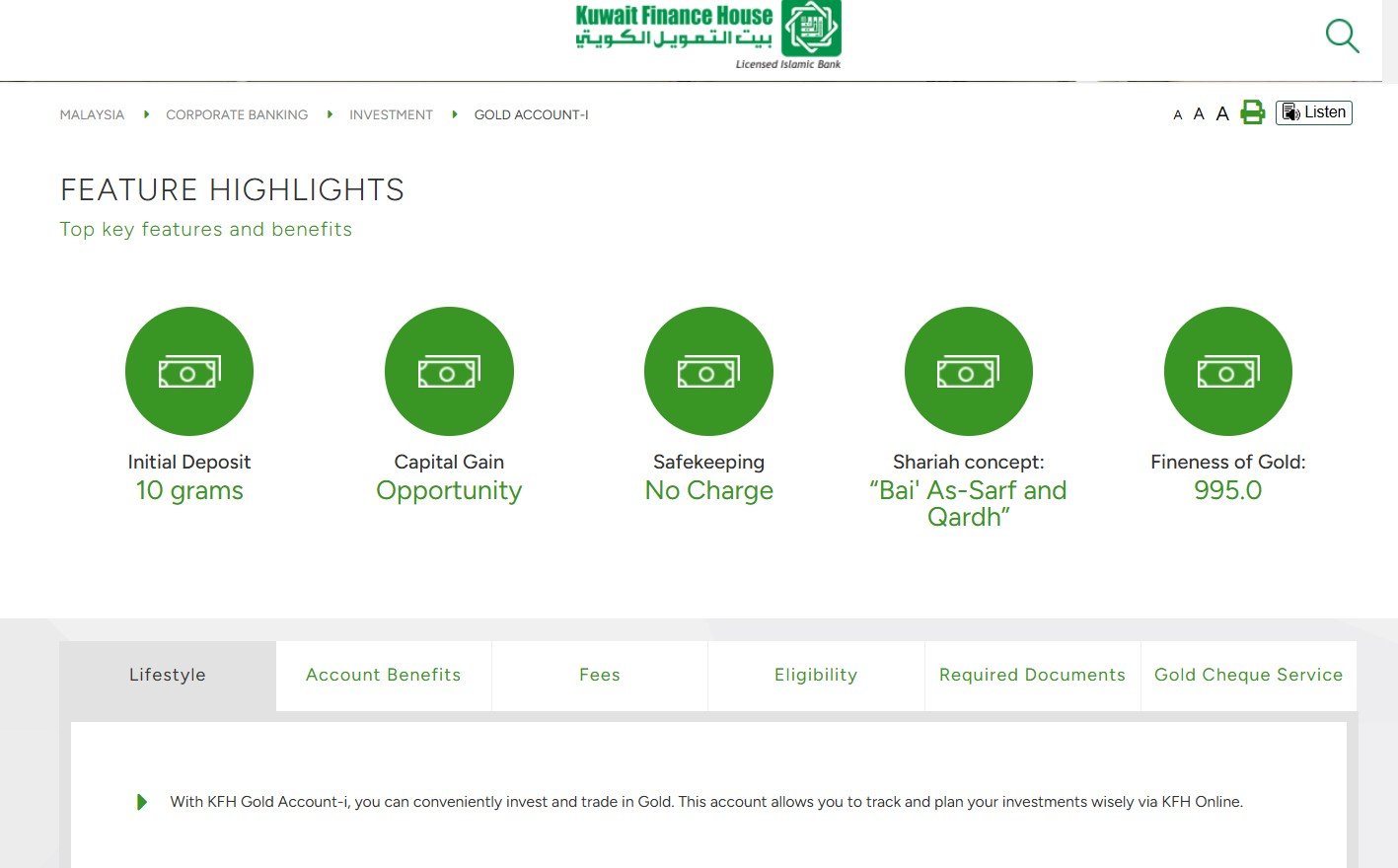

KFH Gold‑i

Bank

4.5 / 5

Fitrah Gold

Dealer

4 / 5

GB GOLD

Dealer

4 / 5

MBSB PrimeGold‑i

Bank

4.3 / 5

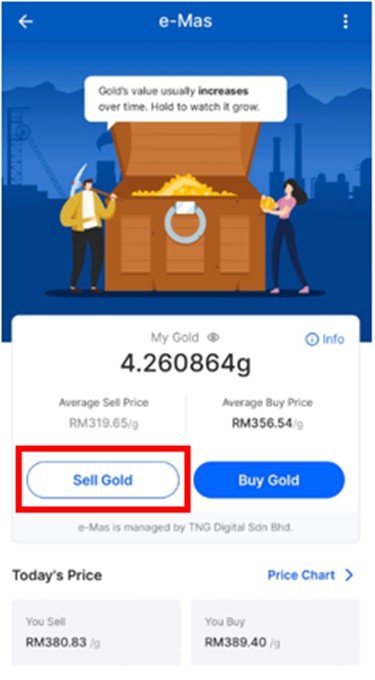

TNGO Emas

eWallet / App

4.4 / 5

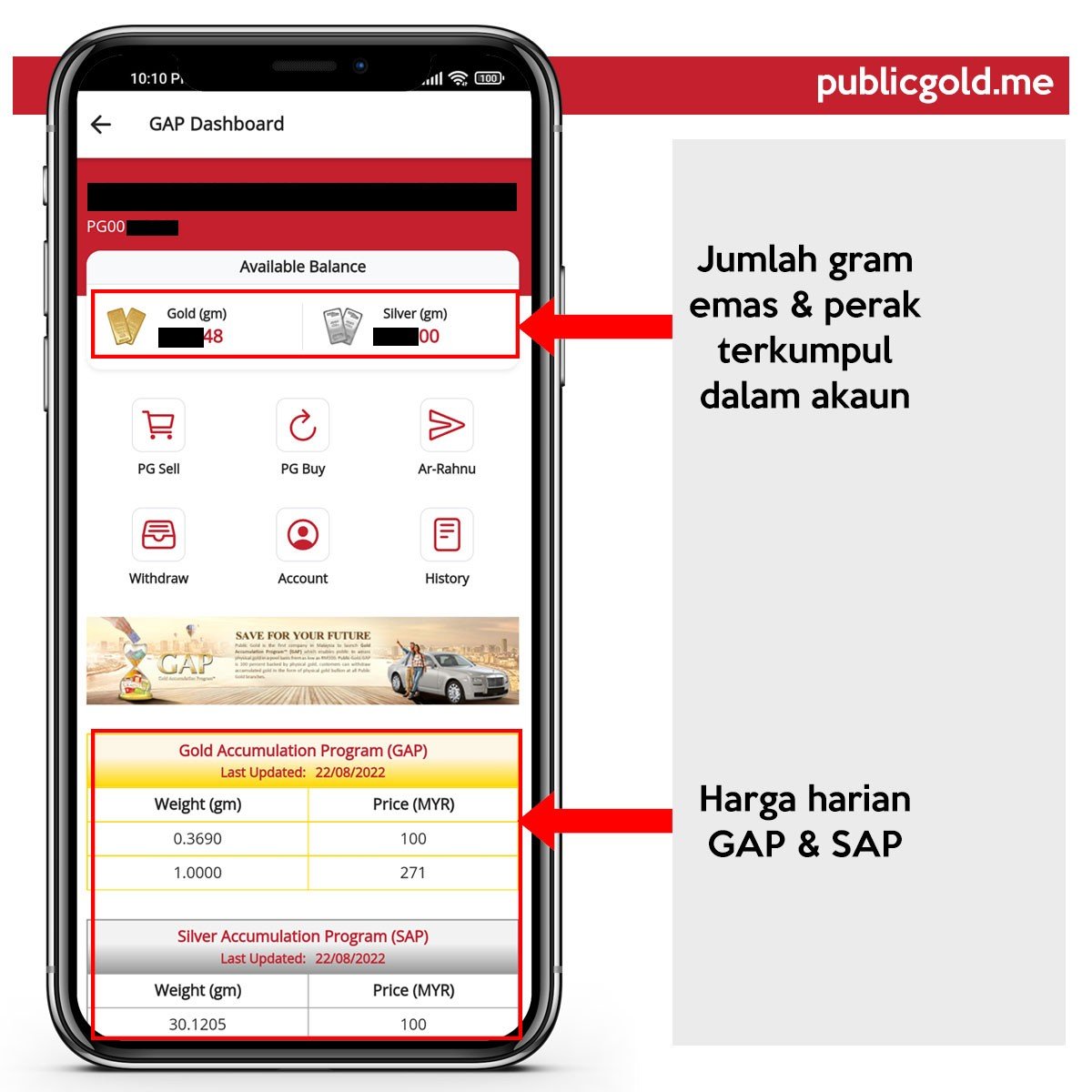

Public Gold GAP

Dealer

4.6 / 5

Best Gold Investment Platforms in Malaysia (2025 Guide)

Last Updated: July 2025

Looking to buy gold online in Malaysia? Whether you’re a beginner or seasoned investor, choosing the right platform matters. This guide compares physical gold dealers, digital savings accounts, ETFs, Shariah-compliant providers, and robo-advisors. Learn about fees, spreads, storage options, and more below. Use the chart to compare platforms side-by-side.

💡 Why Invest in Gold?

- ✅ Hedge against inflation and currency volatility

- ✅ Portfolio diversification

- ✅ Physical and digital options available

- ✅ Widely recognized store of value

📊 Gold Investment Platform Comparison (Malaysia)

Platform | Type | Shariah 🕌 | Min Buy 💰 | Spread 📉 | Admin/Storage Fee 🗃️ | Physical Redemption 🏅 | Rating ⭐ |

|---|---|---|---|---|---|---|---|

Physical/Digital | ✔️ | 1 dinar | ~3–6% | None | ✔️ | 4.4★ | |

Private | ✖️ | 1 g | ~3–5% | May apply | ✔️ | 4.3★ | |

Dealer | ✔️ | 1 g | ~3–6% | None | ✔️ | 4.2★ | |

ETF | ✔️ | 1 unit | ~0.5%/yr | ETF Fee | ✖️ | 4.5★ | |

Dealer | ✔️ | 1 g | ~3–6% | None | ✔️ | 4.1★ | |

Brokerage | ✖️ | 1 oz | Market-based | Broker Fee | ✖️ | 4.0★ | |

Robo-Advisor | ✖️ | RM5 | ~0.5–1.5%/yr | App Fee | ✖️ | 4.6★ | |

Robo-Advisor | ✔️ | RM10 | ~0.5%/yr | ETF Fee | ✖️ | 4.6★ | |

Private | ❓ | RM10 | ~3–5% | May apply | ✔️ | 3.8★ | |

Cooperative | ✔️ | RM10 | ~3–5% | None | ✔️ | 4.2★ | |

Physical Coin | ✔️ | 1 coin | ~2–4% | None | ✔️ | 4.7★ | |

Bank | ✔️ | 1 g | ~3–6% | None | ✔️ | 4.4★ | |

Bank | ✔️ | 1 g | ~3–6% | None | ✔️ | 4.5★ | |

Dealer | ❓ | 1 g | ~4–6% | May apply | ✔️ | 4.0★ | |

Dealer | ❓ | 1 g | ~4–6% | May apply | ✔️ | 4.0★ | |

Bank | ✔️ | 1 g | ~3–5% | None | ✔️ | 4.3★ | |

eWallet / App | ✔️ | RM10 | ~2–3% | None | ✖️ | 4.4★ | |

Dealer | ✔️ | 1 g | ~4–6% | RM10/year (inactive) | ✔️ | 4.6★ |

📦 Types of Gold Investment in Malaysia

- Digital Gold Accounts (e.g., Maybank, CIMB, Public Bank)

- Physical Gold Dealers (e.g., Public Gold, Bursa Gold Dinar)

- Gold ETFs & Robo-Advisors (e.g., Wahed, Versa, Raiz)

- Cooperative / Islamic Gold Accounts (e.g., KFH, Muamalat, KT)

📋 Tips Before You Buy Gold

- Compare spread and fees — lower spread means better value.

- Check if the platform offers physical redemption.

- Confirm Shariah-compliance if needed for Islamic finance purposes.

- Beware of scams or unauthorized dealers.

📌 Frequently Asked Questions (FAQ)

A Shariah-compliant gold account follows Islamic finance rules — gold must be fully backed and not traded on margin. Examples: Public Gold GAP, Maybank MIGA-i.

Most major banks and licensed platforms ensure digital gold is backed by real physical gold. Always check terms and regulation.

Physical gold offers tangible value, while ETFs and robo-advisors offer exposure with low fees. Choose based on your goals.

Yes. Gold prices fluctuate based on global demand, currency, and economic conditions. Spreads and fees can also reduce returns.

Yes. Some platforms allow you to start from as low as RM10 or 1 gram, while others require larger amounts or full coin/bar purchases.

You can sell gold through the platform where you bought it, or at local dealers. Always compare the buy-back price or market rate first.

Bars and coins are physical and can be held or stored; digital gold is managed online and typically backed by real gold but not physically delivered unless redeemed.

Capital gains from gold are currently not taxed for individuals. However, always check latest tax regulations or consult a tax advisor.

Find the latest Gold and Silver Price Updates for Malaysia. Platform to explore Buy Gold Product, Gold Investment, Personal Finance, and Tools and Excel template.